Changes to the 2024-2025 tax rates - what do they mean for you

The Australian government earlier this year approved the stage 3 tax cuts effective as of 1 July 2024 to reduce the marginal tax rates for individual taxpayers.

From taxes to cash flow, Jet Accounting takes the stress out of financial management for individuals and entrepreneurs.

01

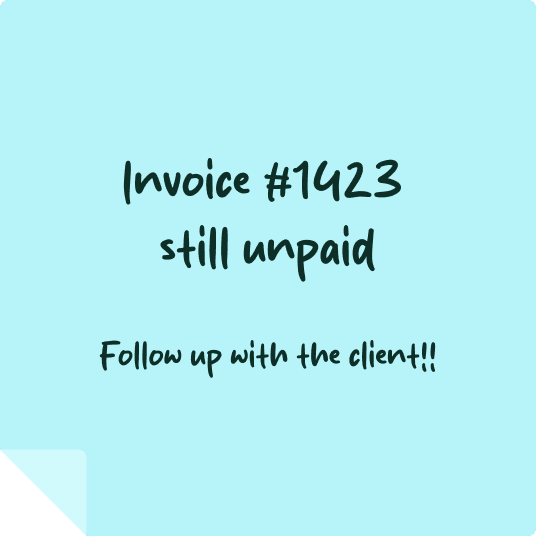

The services you need to ensure you are complying with all of your ATO reporting requirements in a timely manner.

02

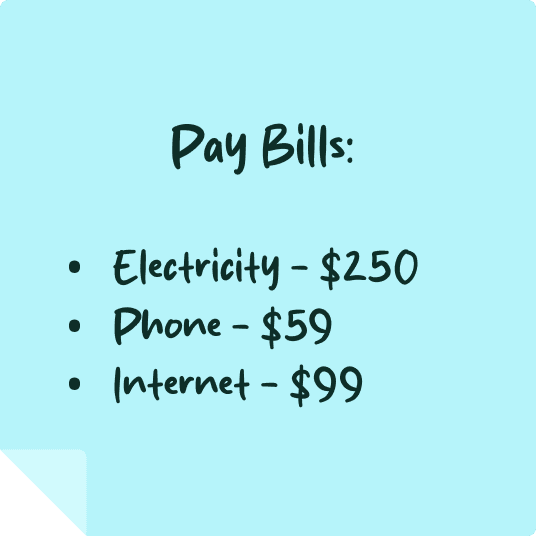

Maintaining your own books and accounts can be time consuming and confusing. Allow us to relieve you from the administrative burden and leave you with an up-to-date file and the data you need to make important business decisions.

03

As your ASIC agent, we can manage the corporate secretarial requirements of your company, giving you piece of mind that you are remaining up to date with your ASIC obligations.

From the first meeting with Jayden, we felt immediately at ease.

From the first meeting with Jayden, we felt immediately at ease.Jayden has been so pivotal in not just helping us to understand our business better, but to our growth and sustainability as a practice. His easy going and friendly nature has made us feel immediately at ease and we trust him with our life!

I really appreciate our quarterly financial catch-ups.

I really appreciate our quarterly financial catch-ups.Ben and Jet Accounting immediately become a valuable partner to our business. Ben immediately built trust, provided strategic guidance and support and allowed me to focus on the business, knowing that he has all of our accounting needs sorted.

They replied faster than I could say “GST”

They replied faster than I could say “GST”They took the time to really understand how my business works, and now it feels like they’re part of the team. They’re friendly, never make me feel silly for asking questions, and manage to explain all financial things in a way that actually makes sense.

One of the best decisions we’ve made for our business.

One of the best decisions we’ve made for our business.Jayden now manages our bookkeeping and monthly BAS, giving us peace of mind in an area that’s well outside our expertise. I genuinely don’t know where our small business would be without his support.

Prompt, honest, engaged, reliable

Prompt, honest, engaged, reliableIt’s rare to find someone so responsive and easy to work with. I wouldn’t hesitate to recommend JET to anyone needing sharp, reliable support in the space.

Ben Audino and the team at Jet accounting & Advisory have been sensational service providers for our business. They have been very professional, reliable and offer expert advice. I would highly recommend their services to any business owner.

The Australian government earlier this year approved the stage 3 tax cuts effective as of 1 July 2024 to reduce the marginal tax rates for individual taxpayers.

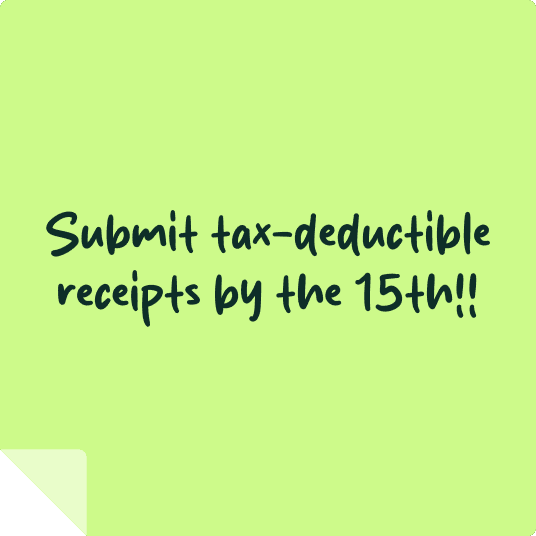

For all those going into business for the first time, it can be a very daunting process establishing yourself, winning work and running the daily operations, let alone managing the administrative back-end on top of this.

Understanding tax law and what rules apply to you can be difficult at the best of times. The rules often vary depending on what industry you’re working in, and what structure you are operating under.